Farah Fahim

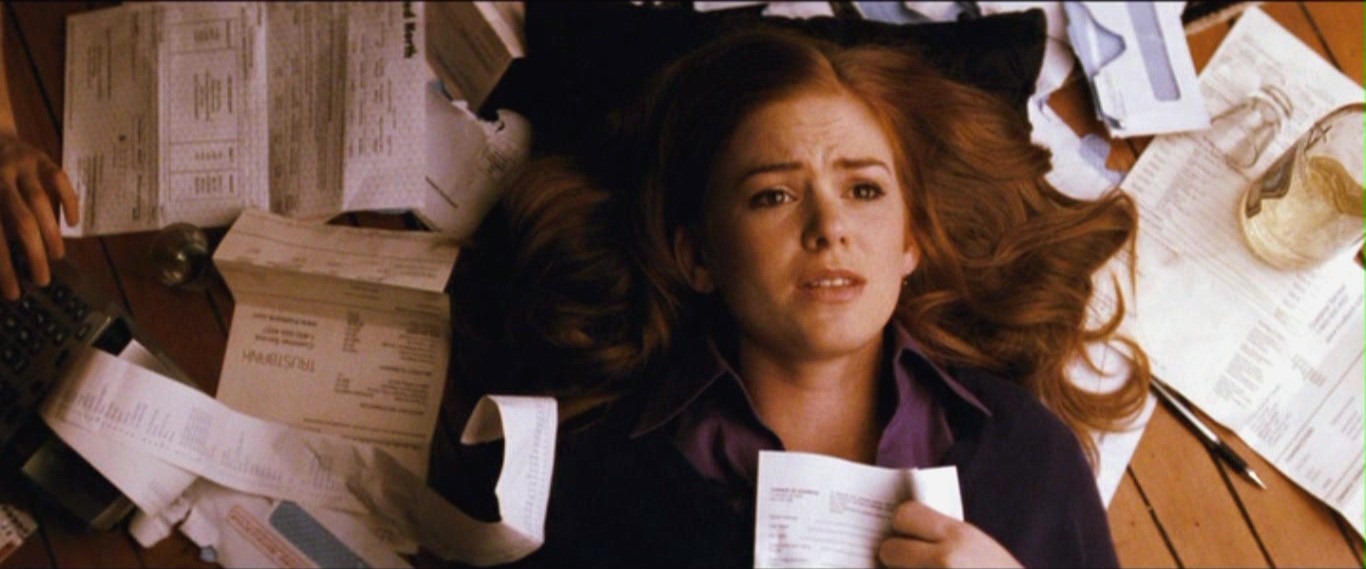

Budgeting is an essential skill for managing your finances effectively. Especially in the world we now live in, plagued with war and economic crisis, it has become more important than ever to allocate our resources efficiently, even if it means giving up a few luxuries. Here are some tips to help you with budgeting:

Track Your Expenses

Start by tracking all your expenses for a month or two. This will give you a clear picture of where your money is going and help you identify areas where you can make adjustments.

Create a Budget

Based on your tracked expenses, create a budget that outlines your income and your planned expenses for each category, such as housing, transportation, groceries, entertainment, and savings. Be realistic and allocate your payments accordingly.

Prioritise Essentials

Ensure that your budget covers your essential expenses first, such as rent/mortgage, utilities, groceries, transportation, and debt payments. These should be given priority over recreational spending.

Set Savings Goals

Determine how much you want to save each month and include it as a line item in your budget. Aim to save a certain percentage of your income regularly, no matter how small the amount. Saving consistently will help you build an emergency fund and work towards your long-term financial goals.

Cut Back on Non-Essential Expenses

Look for areas where you can reduce your spending on non-essential items. Consider cutting back on dining out, entertainment, subscriptions, and impulse purchases. Minor adjustments can add up over time and free up more money for savings or other financial goals.

Use Cash Envelopes or Digital Budgeting Tools

Some people find it helpful to use the cash envelope system, where you allocate a specific amount of cash to each expense category and only spend what’s in the envelope. Others prefer digital budgeting tools and apps that can help track expenses, set financial goals, and provide insights into your spending patterns.

Plan for Irregular Expenses

Anticipate irregular expenses such as car repairs, medical bills, or annual subscriptions, and include them in your budget. Set aside a small amount each month in a separate category to cover these expenses when they arise so you’re not caught off guard.

Review and Adjust Regularly

Regularly review your budget to ensure it aligns with your financial goals and lifestyle. Circumstances change, so be flexible and adjust your budget accordingly. Be mindful of any new expenses or income changes and make appropriate adjustments.

Avoid Debt and Use Credit Wisely

Try to avoid accumulating unnecessary debt. If you do use credit cards, pay off the balance in full each month to avoid interest charges. Only use credit for planned expenses that fit within your budget.

Remember, budgeting is a continuous process, and it may take time to find a system that works best for you. Be patient, stay disciplined, and be mindful of your spending habits. Over time, budgeting can help you achieve financial stability and reach your financial goals.

recommended

Cafés

Cafés

Bite Into the Croffle Craze: The Best 5 Spots to Try Croffles in Cairo

cafes cairo +2 City Life

City Life